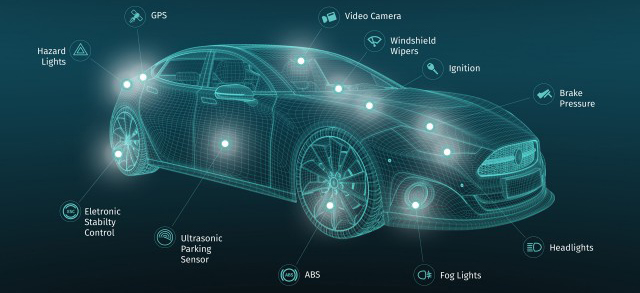

Automotive electronic control systems generally follow the workflow of perception, control and execution. Sensors which work as perception units acquire the system information of operating condition. The control unit deals with the sensor signals, then sends the output control instructions. Finally the execution part accomplishes the corresponding instructions.

Magnetic sensors: new applicable scenes, new technologies

MEMS: superior procedures and technology upgrade

Intelligent driving: improving productivity and transport efficiency

Automotive sensors divide into two categories: vehicle detection and environmental detection. The sensors in the power, chassis, body and electronic systems belong to the vehicle detection, the onboard cameras, millimeter-wave radar and LIDAR in ADAS and driverless systems belong to the environment detection. This article focuses on vehicle detection sensors.

According to the working principle, sensors can divide into MEMS, magnetic, chemical, and temperature four types. There are more than 50 MEMS sensors and 30 magnetic sensors in conventional gasoline vehicles. These together account for about 90% of the total number of sensors. The competitive landscape for each type of sensor is generally straightforward.

Several mainstream companies, such as Bosch, Sensata, Infineon, NXP, and Denso, are the leading suppliers of MEMS pressure sensors. NXP, Infineon, Allegro, TDK-Micronas, Melexis as the leading suppliers of magnetic sensors. Bosch and NTK as the leading suppliers of gas sensors.

Among these sensor companies, the giants such as Bosch, Infineon, NXP have complete product lines and industrial chains. They have strong competitiveness in chip design, manufacture, sensors development, assembling.

Companies like Allegro, Melexis, ST, NTK focus on specific fields or industrial chain. The scale is relatively moderate. These companies also have strong market competitiveness.

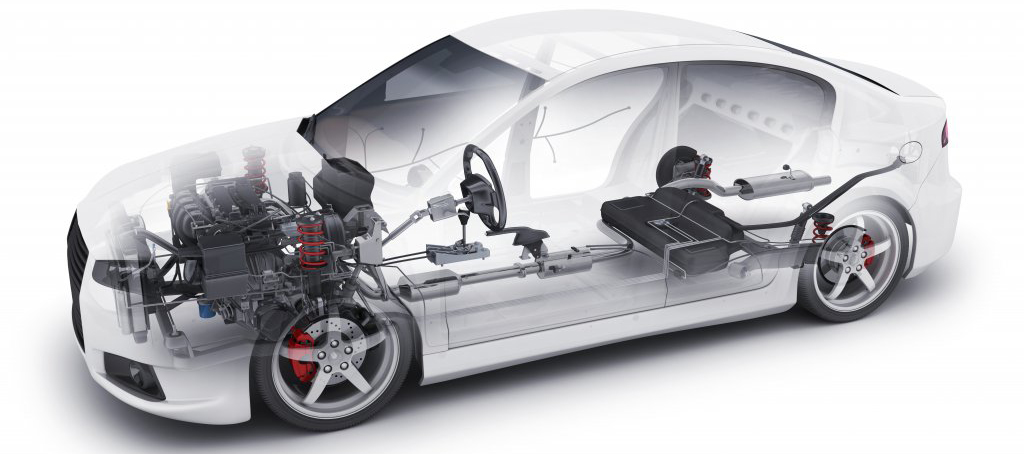

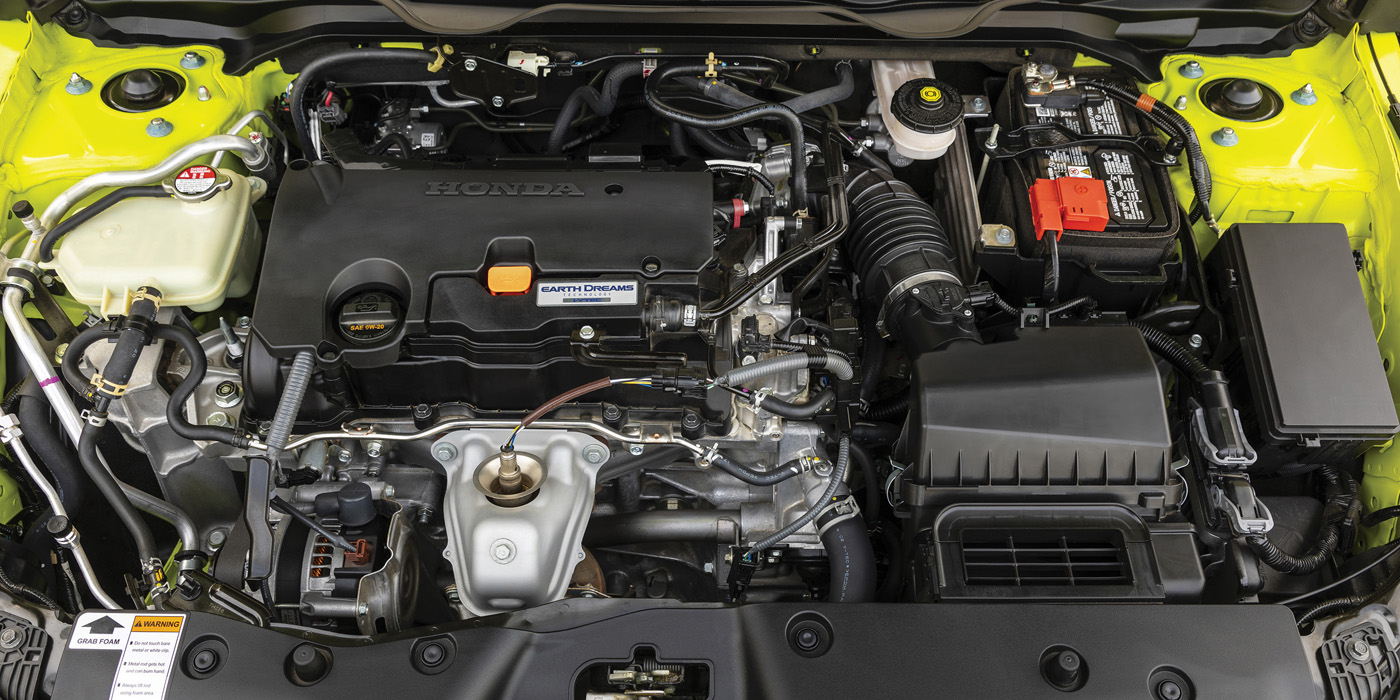

Powertrain requires multiple types of sensors for the intake and exhaust pressure, coolant / fuel / oil temperature, air flow, crankshaft / camshaft position and speed, knock, oxygen sensors, etc., to monitor the engine operating condition simultaneously. There are about 30 - 40 of these sensors in a car.

The transmission system involves complex mechanical conditions of clutches and transmissions. It requires various types of sensors for the clutch / transmission gears, input / output shaft speed sensors and hydraulic oil / coolant temperature sensors. There are about 15 - 20 of these sensors in a car.

Chassis and body safety system sensors spread all over the braking system, steering system, vehicle stability and airbag. There are 30 - 40 such sensors in the car.

For example, acceleration / angular velocity sensors are widely used in the airbag system, electric power steering system and inertial guidance module system.

The body comfort system contains sensors for the rain, sunlight, wiper motor / window-lift motor, air conditioning system, etc. These low-price sensors are more than 20 in a car.

Magnetic sensors: new applicable scenes, new technologies

There are four generations of magnetic sensors: Hall effect, AMR (Anisotropic magnetoresistance effect), GMR (Giant magnetoresistance effect) and TMR (Tunnel magnetoresistance effect) types.

These sensors mainly measure the quantity of motion. The main products are speed sensors, linear and angular position sensors, current sensors, etc.

According to the industry chain, the competition pattern of magnetic sensor chips is clear. Five chip suppliers Allegro, TDK, Melexis, Infineon and NXP, almost monopolize the market.

Comparatively speaking, the global automotive magnetic sensor suppliers are relatively decentralized. Bosch, Delphi, Conti, Denso and many other Tier Ones have their own product series. Those product series support specific automotive electronic systems.

The chip cost is more than 60% of the entire cost of the magnetic sensor (magnetic components usually pack together with ASICs). The sensor suppliers' space for secondary development on the products is compressed, which results in the product homogeneity.

So the relationship between the sensor suppliers and the vehicle manufacturers is particularly critical. The winning factors are product quality, price and service.

Looking for perfect engine sensors? Come to visit Delcoribo. Take a look online. If you want to make an inquiry, just contact us.

Nowadays, chips with increasing integration dominate the development trend of magnetic sensors:

① magnetic components and ASIC integration: from multi-chip to single-chip integrated packages.

② dual-sensor integration: EPS and other systems with high functional safety levels require high sensor redundancy. Usually, there are two torque and pedal sensors. The dual-sensor integrated package helps reduce the size and cut the cost.

1. Hall effect sensors: technology, market maturity

Most of the car engine magnetic sensors are based on the principle of the Hall effect. People also call them Hall effect sensors. They detect presence and motion quantities such as position, speed, angle etc. Hall sensor technology and applications are highly mature. A vehicle has 35 to 50 hall sensors.

The demand growth of hall sensors mainly comes from 3 aspects.

① The continuous upgrading of automotive electronic components, such as electric power steering (EPS), electronic pedals, electric seats, etc.

② The application of the 3D Hall effect. The main products are knob shifters, electronic throttle position sensors, EGR valve position sensors, etc. The application goes into service from luxury cars to economical cars.

③ Current sensors in new energy vehicles are more and more popular in the global market.

The world-leading automotive Hall sensor suppliers are Bosch, Denso, Continental, Valeo and many other Tier Ones. They generally buy magnetic sensor chips from chip manufacturers such as Melexis, Infineon and TDK-Micronas, and design their sensor products according to their electronic control system requirements.

Most suppliers sell products in the form of systems to OEMs. Sensata is an exception. It doesn't offer its products as a system but only sells individual sensor products to OEMs.

2. xMR sensors: outstanding performance, starting to rise in the world

AMR, GMR and TMR are all based on the magnetoresistive principle. As the next generation of magnetic sensors, they are gaining more market share by their strong performance. Major magnetic sensor chip manufacturers all pay attention to this business.

AMR / GMR technology is already being used on a large scale in sensors for wheel speed, steering wheel angle/torque, electronic throttle position, crankshaft and camshaft speed. TMR is expected to put into use in electric power steering systems in the next two years.

Among the sensor manufacturers, Conti and Denso are promoting xMR technology. Conti purchases NXP chips and introduce AMR technology into most of its product lines. Denso relies on its extensive product experience in Hall effect sensors to develop a new generation of sensors with its own AMR chips.

At present, AMR sensors are mainly used by American and Japanese OEMs. Chip manufacturers have different focuses on the xMR field in terms of their technology strength.

TMR sensors offer significant performance improvements by the tunneling magnetoresistance effect of magnetic multilayer materials. Compared to Hall components, AMR and GMR, TMR sensors have the following advantages.

Firstly, good temperature performance. The front-end module is plated with a nano-thick oxide layer rather than a semiconductor.

Secondly, low current consumption, from 5-20mA for Hall down to the μA level.

Thirdly, the high sensitivity and lower cost in mass production. Hall components require powerful magnets.

TMR sensors will replace Hall sensors in high demanding applications thanks to their outstanding performance.

① Angle, speed and position sensors: including BLDC rotor position, steering wheel angle, wheel speed, throttle position, crankshaft / camshaft angle and other applications with very high functional safety level requirements.

② Liquid level sensors: TMR replaces the reed switch, which has poor consistency and high cost is prone to break. TMR has high sensitivity, low cost and overcomes the problem of breakage.

MEMS: superior procedures and technology upgrade

MEMS (Micro-Electro-Mechanical System) is a micro-electro-mechanical system that integrates micro-mechanical structures, micro-sensors, micro-actuators, signal processing, control circuits, interfaces communication and power modules on a chip.

The system is widely used in automotive applications for pressure and motion sensors. There are currently over 50 MEMS sensors in a car.

The advantages of MEMS sensors are significant: high integration, small size, low cost, fully automated control, suitable for mass production. Bosch mass-produced MEMS sensors in 1995, and now they are more and more popular. According to the estimate of IHS, MEMS maintains a steady growth of 3.3% in the automotive industry.

According to the industry structure, Bosch, ST, and TI are leading the product line layout and market share. AKM and other magnetic sensor manufacturers start the business with electronic compass. MEMSIC, ADI, has focused on the inertial module IMU, including automotive accelerometers, gyroscopes, and magnetometers. TDK has purchased pressure sensor company EPCOS, inertial sensor company Invensense and Tronics to support the MEMS product line.

Unlike digital ICs, MEMS chips require high electrical and mechanical characteristics. As a result, both chip capability and packaging processes are core technologies for sensor suppliers.

The combined cost of MEMS chips and ASICs accounts for 60%. At the same time, packaging requires consideration of temperature, chemistry, stress and other factors that have significant impacts on sensor performance.

Referring to the whole industry chain, the competitive landscape for MEMS and ASIC chips is clear. The major suppliers are Bosch, Sensata, NXP (Freescale), Denso, Infineon, ADI.

Sensor product suppliers are more decentralized, with mainstream companies including Bosch, Sensata, Denso, Conti, Delphi, TE, Amphenol, etc. Among them, Bosch has the ability of the whole industry chain. The company uses the IDM model. They produce from the fab to the final automotive electronic system all by themselves.

Sensata can design chips. They can develop sensor products, but they use the Fabless model. All chips are outsourcing produced. Other suppliers such as NXP, Infineon, ADI combine both IDM and Fabless models.

1. Pressure sensors: mature technology, fast-growing in the Chinese market

Pressure MEMS mainly works based on the piezoresistive effect of silicon. The pressure acting on the silicon film changes the resistance of the four resistive strain gauges. The Whiston Bridge outputs a voltage signal proportional to the pressure.

This sensor is suitable for low and medium pressure devices, such as engine intake manifold, tire pressure measurement system (TPMS), to measure vacuum, fuel pressure, etc. Medium and high voltage devices mostly use ceramic capacitors.

Automotive MEMS pressure sensor technology has been very mature. The number of such sensors in a vehicle is 15 to 20. They mainly install in the power transmission and emissions system. Referring to the market demand, Europe, America, Japan, and other developed markets tend to be stable. The Chinese market is rapidly growing.

2. Motion sensors: driverless cars promote the progress of accuracy and integration

There are 10 to 15 motion sensors in a car. They monitor body postures, such as acceleration and angular velocity. In addition, they provide input signals to the automotive electronic system, which contains airbags and the Electronic Stability Programme (ESP).

The demand for automotive motion sensors will increase slightly. The compound growth rate will not exceed 5%, mainly benefiting from the global, especially in developing countries.

Today the MEMS accelerometer and gyroscope of the ESP system are commonly used for inertial navigation in vehicles.

However, they have poor accuracy and can't meet the comfort requirements of driverless cars. The accuracy needs to improve urgently, while the integration level is getting higher to reduce costs.

(1) Accelerometer, gyroscope, magnetometer are in an integrated package, from independent 3-axis sensors to two packages to form a 6-axis electronic compass e-compass or 6-axis IMU module, and then together into a 9-axis IMU module, and some even package the pressure sensor into a 10-axis IMU.

(2) Integration with GNSS and LIDAR for precise vehicle positioning in driverless systems, requiring accuracy up to the centimeter level.

According to IHS Markit, the zero-deflection instability of gyroscopes are in L4/L5 level IMUs ranges from 1°/h-0.1°/h. The price of a single axis is in the range of US$ 10-100 (US$ 30-300 for three axes).

In the future, the Inertial measurement unit (IMU) for autonomous vehicles will have two forces.

On the one hand, traditional MEMS manufacturers such as Bosch and MEMSIC (Aceinna) continue to improve the accuracy of their Inertial measurement unit systems. Bosch's SMI230 six-axis inertial sensor, launched at Electronica in Munich, even outperforming NovAtel's IMU-IGM-A1 in terms of zero-deflection instability.

On the other hand, tactical-grade IMUs are more and more popular from the military to intelligent driving, but they are still expensive. There is still a massive demand for a price reduction before they are put into widespread usage.

Intelligent driving: improving productivity and transport efficiency

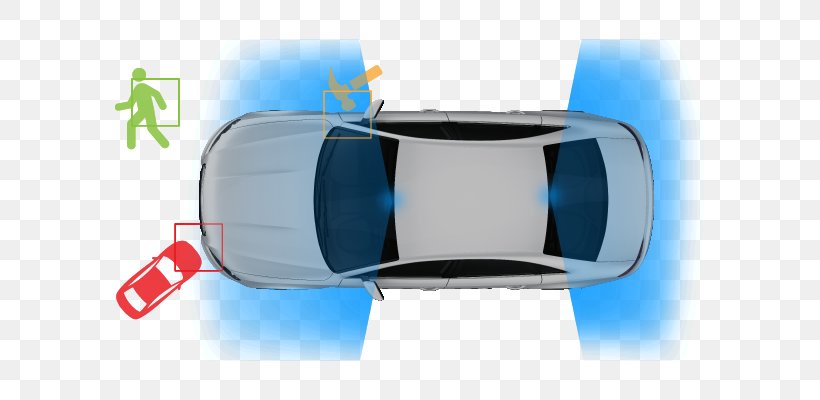

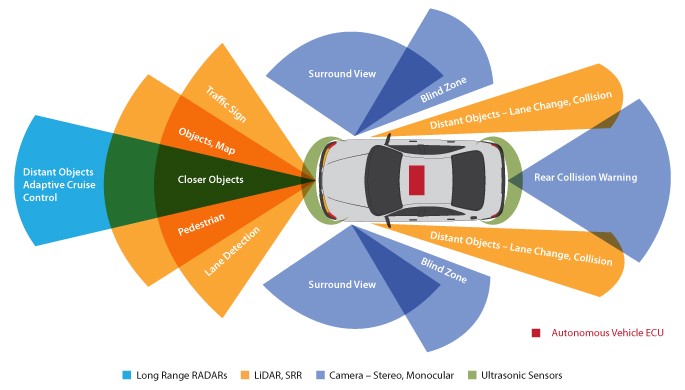

Intelligent driving achieves perception by cameras (long-range, surround and stereo) and radar (ultrasonic, millimeter-wave and lidar). Nowadays, the most advanced intelligent cars use 17 sensors (for autonomous driving functions only). Experts predict that the number will reach 29 by 2030.

1. Car camera: safeguard for property and personal safety

Car camera is widespread and relatively inexpensive. It is the most basic and standard sensor. The camera is essential for multiple ADAS functions. The unit price is expected to remain low in the future, driving rapid growth in the in-car camera market.

According to the report, global in-vehicle camera shipment grows from 28 million in 2014 to 83 million in 2020, a CAGR of 20%. The Americas, Europe and the Asian-Pacific region are mainly consumption regions. The Asian-Pacific region is the fastest-growing market.

2. Automotive radar: obstacle detection, adaptive cruise control

The radar emits sound waves or electromagnetic waves to illuminate a target object. It receives its echoes, which obtaining information on the distance, rate of distance change (radial velocity), size and position of the target object.

Radars were first used in military applications but has since been gradually civilianized. With the development trend of automotive intelligence, radar began to appear in cars, mainly for distance measurement, speed measurement and other functions.

Automotive radar divides into ultrasonic radar, millimeter-wave radar, lidar, etc. The principles of various radars are different. Each performance characteristic has its advantage, which can achieve different functions.

The number of sensors on autonomous vehicle is currently more than 400. With the development of technology, the number of sensors on autonomous vehicles will increase over the next decade.

As a result, the level of sensor requirements will become increasingly demanding. The emergence of autonomous vehicles increases the energy and vitality of the sensor industry.

Looking for more information about engine sensors? Take a look at our other blog posts. If you have good advice, please send a mail to: <a href="mailto

Lauritz Carolsfeld

Lauritz Carolsfeld  June 21, 2021

June 21, 2021